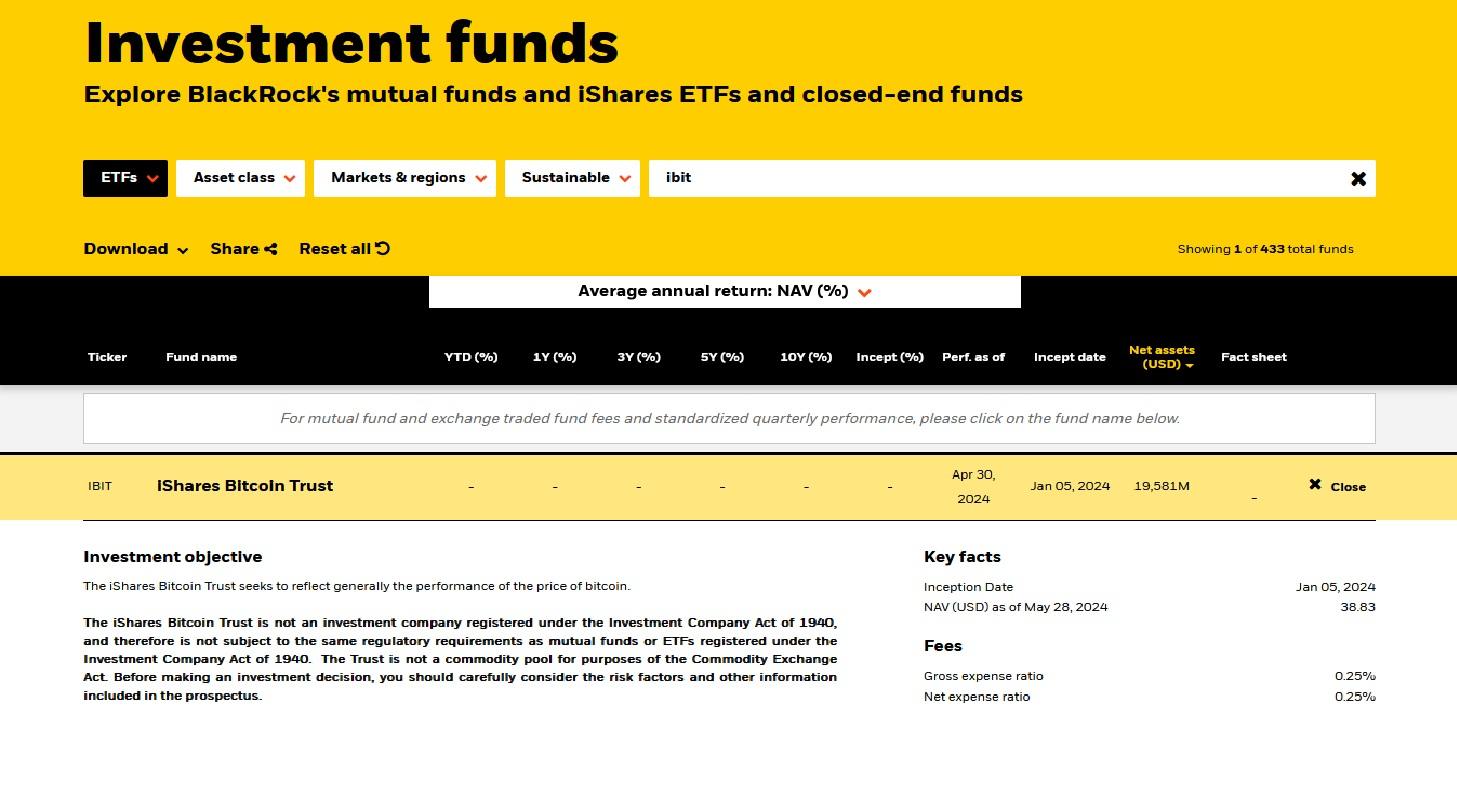

US spot Bitcoin exchange-traded funds drew $697 million of net inflows on Tuesday, the second trading day of 2026.

The move brought total net inflows for the first two trading days of the year to more than $1.1 billion, according to Farside Investors.

Inflows rebound after late-2025 outflows

The early-2026 inflows follow two consecutive months of net outflows from spot Bitcoin ETFs.

The funds saw $3.48 billion in outflows in November and $1.09 billion in December, according to Sosovalue data.

Standard Chartered’s global head of digital assets research Geoff Kendrick previously said spot Bitcoin ETF inflows were a primary driver of bitcoin’s momentum in 2025.

Other ETF flows

Outside bitcoin, spot Ether ETFs attracted $168 million on Monday, marking a second straight day of inflows.

Matrixport cites a “clean-slate effect”

Matrixport pointed to a new year “clean-slate effect,” saying markets reset after $30 billion of bitcoin and ether futures leverage unwound since an October crash.

Matrixport wrote in an X post:

“Entering 2026, positioning is far leaner, speculative excess has been flushed out, and without the weight of crowded trades, Bitcoin and other cryptocurrencies now have room to follow their natural trajectory, which may well be higher.”